Increasing wealth is one of the main reasons people invest. Although investors may have different motivations, some may want money for retirement, others may earn money for other purpose, however, making money is generally the basis of all investments. And it doesn’t matter if you are investing into the stock market, the bond market, or real estate.

Investment in properties on the costa del sol is one example of a real estate investment. These properties may be purchased with the aim of making money from rental income and also from equity value. The equity value is the gain you make after a short period of time from buying and selling the property.

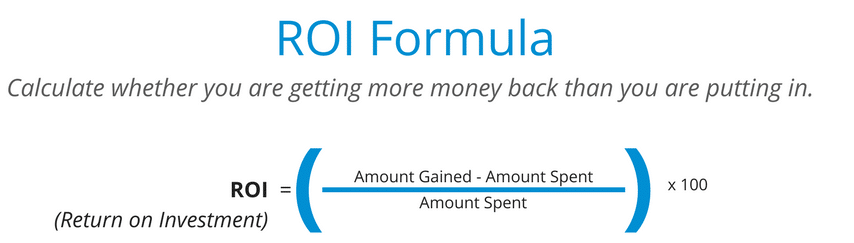

Regardless of the intention, in order to determine the profitability of a property, it is necessary for people who invest in real estate, to calculate return on investment (ROI). This article will take an example of how to measure the return on investment on a rental property in the Costa del Sol and why it is an important variable.

What Is a Return on Investment (ROI)?

Return on investment (ROI) is a ratio between net profit (over a period) and cost of investment (resulting from an investment of some resources at a point in time). A high ROI means the investment’s gains compare favorably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several different investments.[1] In economic terms, it is one way of relating profits to capital invested.

In business, the purpose of the return on investment (ROI) metric is to measure, per period, rates of return on money invested in an economic entity in order to decide whether or not to undertake an investment. It is also used as an indicator to compare different investments within a portfolio. The investment with the largest ROI is usually prioritized, even though the spread of ROI over the time period of an investment should also be taken into account.

The return on investment can be for stocks, bonds, a savings account, even on a property. Calculating a meaningful ROI for a residential property can be challenging because calculations can be easily manipulated, certain variables can be included or excluded in the calculation.

Here we will analyze two examples of how to measure ROI on a residential rental property a cash purchase and a mortgage-funded.

To calculate the profit or gain on any investment, first take the total return on the investment and subtract the original cost of the investment. Since ROI is a profitability ratio, it gives us the profit on an investment represented in percentage terms.

The profit is represented in percentage terms.

To calculate the percentage return on investment, we take the net profit or net gain on the investment and divide it by the original cost.

For instance, if you buy A stock for €1.000 and sell it two years later for €1.500, the net profit is €500 (€1.500 – €1.000). The ROI on the stock is 50% [€500 (net profit) ÷ €1,000 (cost) = 0.50].

Calculating the ROI on Rental Properties

The above calculation seems simple to measure, but bear in mind that there are a number of variables that can influence ROI numbers when dealing with real estate properties investment on the Costa del Sol. These include costs for repair and maintenance, community fees, mortgage plus interest etc.

ROI for Cash Transactions

Calculating a property’s ROI is fairly simple if you buy a property with cash. Here’s an example of a rental property purchased with cash:

- You paid €250.000 in cash for the rental property.

- The remodeling costs totaled €5.000 bringing your total investment to €255,000 for the property.

- You collect €16.000 in rent every year.

A year later:

- You earned €16.000 in rental income for those 12 months.

- Expenses including the water bill, property taxes, insurance and community fees totaled €2.800 for the year or €233 per month.

- Your annual return is €13.200 (€16.000 – €2.800).

To calculate the property’s ROI:

- Divide the annual return (€13.200) by the amount of the total investment or €250.000.

- ROI = €13.200 ÷ €255.000 = 0.052 or 5.2%.

- Your ROI was 5.2%.

(Please note that this ROI doesn’t take into account the added equity value of the property during the years)

ROI for Financed Transactions

Calculating the ROI on financed transactions is more involved.

For example, you purchased the same €250.000 rental property as above, but instead of paying cash, you took out a mortgage.

- The initial payment needed for the mortgage was 20% of the purchase price or €50,000 (€250.000 sales price x 20%).

- Closing costs were higher, which is typical for a mortgage, totaling €2.500 up front.

- You paid €5.000 for refurbishing.

- Your total expenses were €57.500 (€50.000 + €2.500 + €5.000).

There are also ongoing costs with a mortgage:

- Let’s assume you took out a 30-year loan with a fixed 4% interest rate. On the borrowed €200.000 (€250,000 sales price minus the €50.000 down payment), the monthly principal and interest payment would be €577,7

- We’ll add the same €233 a month to cover water, taxes, and insurance, community fees, making your total monthly payment €810,7

- Rental income of €1.333 per month totals €16.000 for the year.

- Your monthly cash flow is of €523 monthly (€1.333 rent – €810,7 mortgage payment).

One year later:

- You earned €16.000 in total rental income for the year at €1.333 per month.

- Your annual return was €6.276 (€523 x 12 months).

To calculate the property’s ROI:

- Divide the annual return by your original out-of-pocket expenses (the down payment of €50.000, closing costs of €2.500 and remodeling for €5.000) to determine the ROI.

- ROI: €6.276 ÷ €57.500 = 0.109

- Your ROI is 10.9%.

Home Equity

Some investors add the home’s equity into the equation. Equity is the market value of the property minus the total loan amount outstanding. Please keep in mind that home equity is not cash-in-hand. You would have to sell the property to access it.

To calculate the amount of equity in your home, review your mortgage amortization schedule to find out how much of your mortgage payments went toward paying down the principal of the loan. This builds up the equity in your home.

The equity amount can be added to the annual return. In our example, the amortization schedule for the loan showed that a total of €5.000 of principal was paid down during the first 12 months.

- The new annual return, including the equity portion, equals €11.276 (€6.276 annual income + €5.000 equity).

- ROI = €11.276 ÷ €57.500 = 0.196.

- Your ROI is 19,6%.